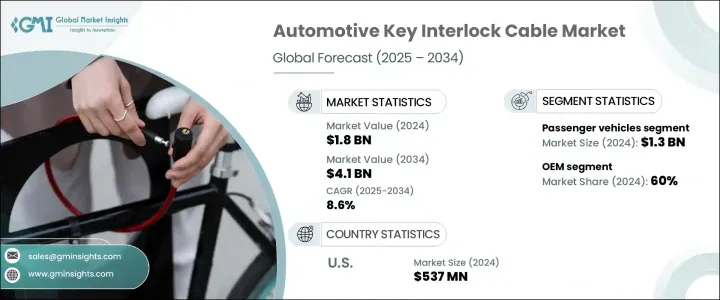

세계의 차량용 키 인터록 케이블 시장 규모는 2024년에 18억 달러로 평가되었고, 자동차 안전성에 대한 기대 증가, 오토매틱 변속기 시스템 통합 진전, 자동차 분야 안전 규제 엄격화등을 배경으로, CAGR 8.6%로 성장하여 2034년에는 41억 달러에 이를 것으로 예측됩니다. 자동차 제조업체는 의도파관 않는 기어시프트를 방지해, 안전성을 높여 컴플라이언스 요구를 채우기 위해서, 첨단인터락·시스템을 차량에 짜넣고 있습니다.

차량 설계가 고도화됨에 따라, 이러한 케이블은 특히 기어 조작을 점화 상태와 연관시켜야 하는 시스템에서 운전자의 제어를 보장하는 중요한 구성 요소로서 역할을 하고 있습니다. 이러한 케이블의 채택은 전기차를 포함한 상용차 및 승용차 부문 모두에서 증가하고 있습니다.

차량이 ADAS(첨단 운전자 보조 시스템)와 반자율 주행 시스템으로 계속 진화함에 따라 고성능, 소형, 내구성이 뛰어난 키 인터록 솔루션에 대한 수요가 가속화되고 있습니다. 이러한 케이블은 기어 변속 기능을 안정적으로 제어하고 잠재적인 운전 실수를 줄이기 때문에 안전이 중요한 자동차 시스템에 필수적입니다. 제조업체들은 또한 인장 강도 강화 및 가혹한 환경 조건에 대한 내성과 같은 특징에 주목하여 케이블이 다양한 스트레스 하에서 효율적으로 작동할 수 있도록 합니다. 인터록 시스템은 다양한 플랫폼에서 최신 자동차 아키텍처의 핵심이 되고 있습니다.

| 시장 범위 | |

|---|---|

| 개시 연도 | 2024년 |

| 예측연도 | 2025-2034년 |

| 개시 금액 | 18억 달러 |

| 예측 금액 | 41억 달러 |

| CAGR | 8.6% |

승용차 부문은 2024년 13억 달러 규모 시장을 창출했습니다. 이는 전기 자전거, 전기 스쿠터, 소형 전기자동차 등 소형 모빌리티 솔루션에 대한 수요 증가에 따른 것으로, 대부분 안전성을 높이기 위해 연동 케이블이 장착된 소형 모빌리티 솔루션에 대한 수요가 증가했기 때문입니다. 가볍고 접을 수 있는 이동수단은 실용적이고 안전한 이동 수단을 찾는 도시 거주자와 이동이 잦은 근로자들 사이에서 특히 인기가 높아지고 있습니다. 이러한 연동 케이블은 사용하지 않을 때 차량의 이동을 방지하고, 특히 공용 공간에서 도난 방지를 강화하는 데 중요한 역할을 합니다.

판매 채널 측면에서 2024년 시장 점유율의 60%는 주문자 상표 부착 제품 제조업체(OEM)가 차지했으며, OEM은 이러한 기술 혁신의 최전선에 있으며, 다양한 차량에 키 인터록 케이블을 필수 부품으로 통합하고 있습니다. 기존 시스템과의 완벽한 호환성을 제공하고 안정적인 성능을 보장하는 능력으로 인해 인터록 케이블은 최신 차량 설계에 필수적인 부품으로 자리 잡았습니다. 스마트하고 자동화된 잠금 메커니즘의 개발 등 인터록 기술의 끊임없는 발전은 OEM 공급 케이블이 선호되는 요인으로 작용하고 있습니다.

미국의 자동차 키 연동 케이블 시장은 강력한 자동차 부문, 엄격한 안전 규정, 전기자동차 및 자율 주행 차량의 높은 채택률로 인해 2024년 5억 3,700만 달러 규모 시장을 창출했습니다. 시장 확대가 지속됨에 따라 미국 제조업체들은 보다 진보되고 내구성이 뛰어나며 효율적인 연동 시스템을 개발하기 위해 연구개발에 많은 투자를 하고 있습니다. 이러한 지속적인 기술 혁신과 자동차 안전 강화를 위한 규제 강화가 결합되어 미국이 자동차 키 인터록 케이블 시장의 선두주자로 남을 것임이 확실합니다.

Suprajit, Orscheln, HI-Lex, Linamar, DURA, Ficosa, Kongsberg, Cablecraft, Kuster 등 주요 기업들은 전략적 제휴, 제품 커스터마이징, 생산 기지 확장에 집중하며 시장에서의 입지를 강화하고 있습니다. 이들 기업은 제품 수명과 진화하는 차량 아키텍처와의 호환성을 향상시키기 위한 연구에 투자하는 한편, OEM과의 파트너십을 활용하여 장기 공급 계약을 확보하고 있습니다.

The Global Automotive Key Interlock Cable Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 8.6% to reach USD 4.1 billion by 2034, fueled by heightened vehicle safety expectations, the growing integration of automatic transmission systems, and stricter safety regulations in the automotive sector. Automakers are embedding advanced interlock systems into vehicles to prevent unintended gear shifts, enhancing safety and meeting compliance demands. As vehicle design becomes more sophisticated, these cables serve as crucial components for ensuring driver control, especially in systems where gear operation must be tied to ignition status. The adoption of these cables is growing in both commercial and passenger vehicle segments, including electric vehicles.

As vehicles continue to evolve with advanced driver-assist technologies and semi-autonomous systems, the demand for high-performance, compact, and durable key interlock solutions is accelerating. These cables offer reliable control over gear shift functions and reduce potential driver error, making them essential for safety-critical automotive systems. Manufacturers are also focusing on features such as enhanced tensile strength and resistance to harsh environmental conditions, allowing cables to operate efficiently under variable stresses. Interlock systems have become a cornerstone in modern vehicle architectures across various platforms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $4.1 Billion |

| CAGR | 8.6% |

The passenger vehicles segment generated USD 1.3 billion in 2024, driven by the rising demand for compact mobility solutions such as e-bikes, electric scooters, and small electric cars-many of which feature interlock cables for enhanced safety. Lightweight, foldable vehicles have become particularly popular among urban dwellers and mobile workers seeking practical, secure transportation. These interlock cables play a crucial role by preventing vehicle movement when not in use and offering additional theft protection, especially in shared spaces.

From a sales channel perspective, original equipment manufacturers (OEMs) held 60% of the market share in 2024, driven by the growing demand for enhanced vehicle safety and technological sophistication. OEMs are at the forefront of this innovation, integrating key interlock cables as integral components in a wide range of vehicle models. Their ability to provide seamless compatibility with existing systems and ensure reliable performance makes them an essential part of modern vehicle design. The constant advancements in interlock technology, including the development of smart and automated locking mechanisms, are contributing to the increased preference for OEM-supplied cables.

United States Automotive Key Interlock Cable Market generated USD 537 million in 2024 due to its strong automotive sector, rigorous safety regulations, and high adoption rates of electric and autonomous vehicles. As the market continues to expand, U.S. manufacturers are heavily investing in research and development to create more advanced, durable, and efficient interlock systems. This ongoing technological innovation, coupled with increased regulatory enforcement aimed at improving vehicle safety, ensures that the U.S. will remain a leader in the automotive key interlock cable market.

Key players such as Suprajit, Orscheln, HI-Lex, Linamar, DURA, Ficosa, Kongsberg, Cablecraft, Kuster, and Kongsberg (duplicate removed) are reinforcing their market position by focusing on strategic collaborations, product customization, and expanding their production footprint. These companies invest in research to improve product longevity and compatibility with evolving vehicle architectures while leveraging partnerships with OEMs to secure long-term supply agreements.