세계의 전자 비행 계기 시스템 시장 : 기회, 성장 촉진요인, 산업 동향 분석, 예측(2025-2034년)

Electronic Flight Instrument System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

상품코드

:

1750297

리서치사

:

Global Market Insights Inc.

발행일

:

2025년 05월

페이지 정보

:

영문 185 Pages

ㅁ Add-on 가능: 고객의 요청에 따라 일정한 범위 내에서 Customization이 가능합니다. 자세한 사항은 문의해 주시기 바랍니다.

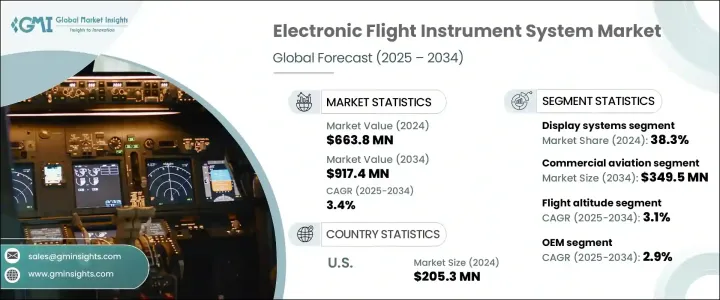

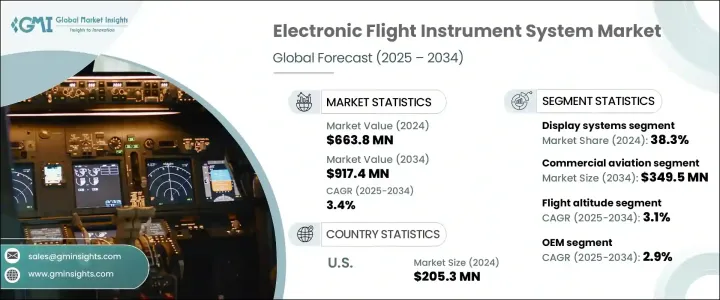

세계의 전자 비행 계기 시스템 시장은 2024년 6억 6,380만 달러로 평가되었고, 민간 항공기 납품 급증, 세계 항공 여행 증가, 항공사 장비 갱신의 꾸준한 증가로 CAGR 3.4%로 성장해 2034년까지 9억 1,740만 달러에 달할 것으로 예측되고 있습니다.

항공 교통량이 증가하고, 운항 회사가 안전성과 운항 정밀도를 우선함에 따라, 실시간으로 통합된 비행 데이터에 대한 수요가 신조기와 개수기 모두에서 EFIS의 채용에 기여하고 있습니다.

그러나 미국이 항공우주 및 항공전자기기 부품에 부과한 관세로 인해 시장은 일시적인 역풍에 직면했습니다. 가격 설정과 부품 입수의 불확실성에 의해 민간 부문과 방위 부문 모두에서 단기적인 시장 감속으로 이어졌습니다.

| 시장 범위 |

| 시작 연도 |

2024년 |

| 예측 연도 |

2025-2034년 |

| 시작 금액 |

6억 6,380만 달러 |

| 예측 금액 |

9억 1,740만 달러 |

| CAGR |

3.4% |

컴포넌트별로 컨트롤 패널 부문은 2025-2034년 CAGR이 4.6%로 예상됩니다. 이 시스템은 실시간 데이터 통합 및 원활한 인터페이스 사용자 정의를 가능하게 하며, 미션 프로파일 및 항공기 범주를 지원합니다.

민간항공 분야는 2034년까지 3억 4,950만 달러의 매출이 예상되고 있습니다. 또한 비용 효율성에 대한 노력과 연료 최적화가 노후화 된 항공기의 리노베이션을 촉진하고 있습니다.

미국은 전자 비행 계기 시스템(EFIS)의 기술 혁신이 견인해, 2024년 시장 규모는 2억 530만 달러에 달했습니다. 대규모 민간 항공기 개수 프로그램과 전략적 방위 업그레이드의 조합이 이 분야의 성장에 기여하고 있습니다.

세계의 전자 비행 계기 시스템 시장의 주요 기업으로는 BAE Systems, Aspen Avionics, Avidyne Corporation, Garmin, Genesys Aerosystems, Dynon Avionics 등이 있습니다. Dynon Avionics, Genesys Aerosystems, Avidyne Corporation, Garmin, Aspen Avionics, BAE Systems와 같은 전자 비행 계기 시스템 시장에서 사업을 전개하는 기업은 세계적인 사업 전개를 강화하기 위해 몇 가지 중요한 전략을 채택하고 있습니다. OEM 및 규제 기관과의 협업은 진화하는 항공 표준에 대한 컴플라이언스를 합리화하는 데 도움이 됩니다.

목차

제1장 조사 방법과 범위

제2장 주요 요약

제3장 업계 인사이트

- 생태계 분석

- 트럼프 정권의 관세 분석

- 무역에 미치는 영향

- 업계에 미치는 영향

- 공급측의 영향(원재료)

- 주요 원재료의 가격 변동

- 공급망 재구성

- 생산 비용에 미치는 영향

- 수요측의 영향(판매가격)

- 최종 시장에의 가격 전달

- 시장 점유율 동향

- 소비자의 반응 패턴

- 영향을 받는 주요 기업

- 전략적인 업계 대응

- 공급망 재구성

- 가격 설정 및 제품 전략

- 정책관여

- 전망과 향후 검토 사항

- 업계에 미치는 영향요인

- 성장 촉진요인

- 차세대 항공기에 있어서의 선진적인 아비오닉스 수요 증가

- 민간 항공기의 납품과 기체수 증가

- 항공 여객수 증가와 항공사의 운항 효율

- 통합항공전자기기 아키텍처 채용 증가

- 확대하는 군 및 방위 항공 부문

- 업계의 잠재적 위험 및 과제

- 고액의 초기 투자와 리노베이션 비용

- 기존 항공전자기기 시스템과의 복잡한 통합

- 성장 가능성 분석

- 규제 상황

- 기술의 상황

- 장래 시장 동향

- 갭 분석

- Porter's Five Forces 분석

- PESTEL 분석

제4장 경쟁 구도

- 소개

- 기업의 시장 점유율 분석

- 주요 시장 기업의 경쟁 분석

- 경쟁 포지셔닝 매트릭스

- 전략 대시보드

제5장 시장 추계 및 예측 : 컴포넌트별, 2021-2034년

- 주요 동향

- 디스플레이 시스템

- 제어판

- 처리 시스템

- 기타

제6장 시장 추계 및 예측 : 플랫폼별, 2021-2034년

- 주요 동향

- 민간항공

- 군사항공

- 비즈니스 및 일반 항공

- 무인 항공기(UAV)

제7장 시장 추계 및 예측 : 용도별, 2021-2034년

- 주요 동향

- 비행고도

- 네비게이션

- 정보 관리

- 엔진 감시

- 기타

제8장 시장 추계 및 예측 : 최종 용도별, 2021-2034년

- 주요 동향

- OEM

- 애프터마켓(MRO 및 항공전자기기 업그레이드)

제9장 시장 추계 및 예측 : 지역별, 2021-2034년

- 주요 동향

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 아랍에미리트(UAE)

제10장 기업 프로파일

- Aspen Avionics

- Avidyne Corporation

- BAE Systems

- Dynon Avionics

- Garmin

- Genesys Aerosystems

- Honeywell International

- Kanardia

- L3Harris Technologies

- LPP SRO

- Meggitt

- MGL Avionics

- Taskem Corporation

- Thales

- Universal Avionics

JHS

영문 목차

The Global Electronic Flight Instrument System Market was valued at USD 663.8 million in 2024 and is estimated to grow at a CAGR of 3.4% to reach USD 917.4 million by 2034, driven by a surge in commercial aircraft deliveries, rising global air travel, and a steady increase in airline fleet upgrades. As air traffic grows and operators prioritize safety and operational precision, demand for real-time, integrated flight data is fueling the adoption of EFIS in both new aircraft and retrofits. These systems streamline flight planning, fuel usage, and navigation, aligning with the aviation industry's push for more efficient and secure flight operations.

However, the market faced temporary headwinds due to US-imposed tariffs on aerospace and avionics components. These measures significantly raised costs for domestic manufacturers, disrupting supply chains and delaying the integration of cutting-edge flight systems. Some suppliers responded by localizing production to counteract the tariff impact, but uncertainty in pricing and part availability led to short-term market slowdowns in both commercial and defense sectors. Despite these challenges, aviation stakeholders continue to prioritize avionics upgrades, especially those complying with evolving regulatory requirements and safety mandates.

| Market Scope |

|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $663.8 Million |

| Forecast Value | $917.4 Million |

| CAGR | 3.4% |

Within components, the control panels segment held a 4.6% CAGR during 2025-2034. Advancements such as high-resolution touch-screen displays, reconfigurable layouts, and modular hardware designs are enhancing cockpit ergonomics and streamlining pilot workflows. These systems allow real-time data integration and seamless interface customization, catering to mission profiles and aircraft categories. Enhanced compatibility with smart avionics suites and next-gen flight management systems fuels adoption, particularly in multi-role aircraft that demand flexibility and efficiency.

The commercial aviation segment is expected to generate USD 349.5 million by 2034. Airlines are replacing legacy systems with next-generation EFIS that support real-time weather data, advanced terrain mapping, and traffic visualization. In addition, cost-efficiency initiatives and fuel optimization prompt retrofitting across aging aircraft fleets. Many carriers are moving toward predictive analytics-enabled systems that improve safety margins and offer real-time insights during flight.

U.S. Electronic Flight Instrument System Market generated USD 205.3 million in 2024, driven by the innovation in electronic flight instrument systems (EFIS). A combination of large-scale commercial aircraft retrofitting programs and strategic defense upgrades contributes to the sector's growth. Government-driven initiatives enhance situational awareness, cyber-resilience, and autonomous capabilities, and foster increased investment in digital cockpit solutions.

Key players in Global Electronic Flight Instrument System Market include BAE Systems, Aspen Avionics, Avidyne Corporation, Garmin, Genesys Aerosystems, and Dynon Avionics. Companies operating in the electronic flight instrument system market-such as Dynon Avionics, Genesys Aerosystems, Avidyne Corporation, Garmin, Aspen Avionics, and BAE Systems-are adopting several key strategies to enhance their global footprint. Many are investing in R&D to create AI-integrated and modular EFIS platforms that support manned and unmanned aircraft. Collaborations with OEMs and regulatory bodies are helping streamline compliance with evolving aviation standards. Manufacturers focus on user-centric innovations such as customizable interfaces and touchscreen panels to meet demand across commercial, military, and general aviation sectors.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Increasing demand for advanced avionics in next-generation aircraft

- 3.3.1.2 Rise in commercial aircraft deliveries and fleet expansion

- 3.3.1.3 Growth in air passenger traffic and airline operational efficiency

- 3.3.1.4 Increased adoption of integrated avionics architectures

- 3.3.1.5 Expanding military and defense aviation sector

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High initial investment and retrofit costs

- 3.3.2.2 Complex integration with existing avionics systems

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 Pestel analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Component, 2021-2034 (USD Million & units)

- 5.1 Key trends

- 5.2 Display systems

- 5.3 Control panels

- 5.4 Processing systems

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Platform Type, 2021-2034 (USD Million & units)

- 6.1 Key trends

- 6.2 Commercial aviation

- 6.2.1 Narrow-body aircraft

- 6.2.2 Wide-body aircraft

- 6.2.3 Regional jets

- 6.3 Military aviation

- 6.3.1 Fighter jets

- 6.3.2 Transport & reconnaissance aircraft

- 6.3.3 Military helicopters

- 6.4 Business & general aviation

- 6.5 Unmanned aerial vehicles (UAVs)

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & units)

- 7.1 Key trends

- 7.2 Flight altitude

- 7.3 Navigation

- 7.4 Information management

- 7.5 Engine monitoring

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million & units)

- 8.1 Key trends

- 8.2 OEM (original equipment manufacturer)

- 8.3 Aftermarket (MROs and avionics upgrades)

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & units)

- 9.1 Key trends

- 9.2 North America

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Aspen Avionics

- 10.2 Avidyne Corporation

- 10.3 BAE Systems

- 10.4 Dynon Avionics

- 10.5 Garmin

- 10.6 Genesys Aerosystems

- 10.7 Honeywell International

- 10.8 Kanardia

- 10.9 L3Harris Technologies

- 10.10 LPP SRO

- 10.11 Meggitt

- 10.12 MGL Avionics

- 10.13 Taskem Corporation

- 10.14 Thales

- 10.15 Universal Avionics