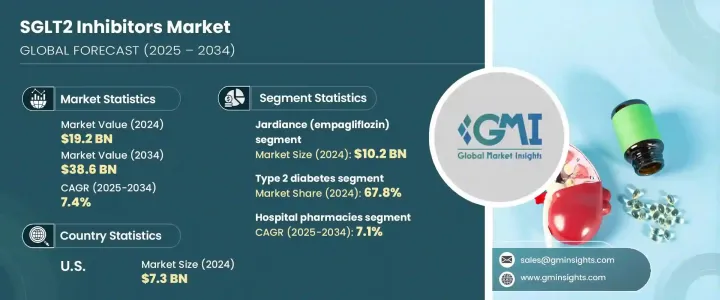

세계의 SGLT2 억제제 시장은 2024년에는 192억 달러로 평가되었고, CAGR 7.4%로 성장할 전망이며, 2034년에는 386억 달러에 이를 것으로 추정됩니다.

이것은 운동 부족, 고령화, 비만율 상승 등의 라이프 스타일 요인에 의해 수백만 명이 앓고 있는 2형 당뇨병의 세계 유병률 증가가 견인하고 있습니다. 당뇨병 치료제는 혈당을 낮출 뿐만 아니라 특히 심혈관이나 신장에 합병증을 가진 환자에게 여러 가지 이점을 가져다주기 때문에 치료제로 두드러지고 있습니다. 만성적인 건강 상태의 관리에 있어서의 역할의 확대는, 환자층을 크게 넓히고 있습니다.

SGLT2 억제제는 기존의 당뇨병 치료제와 달리 신장의 포도당 배설을 촉진하여 포도당 수준을 낮추기 때문에 혈당 조절을 지원할뿐만 아니라 심혈관과 신장 보호에도 기여합니다. 그 때문에, 환자에게도 헬스케어 프로바이더에게도 선호되는 선택지가 되고 있습니다. 심부전이나 신장병 환자의 입원율 및 사망률의 감소를 나타내는 임상시험의 에비던스가 축적됨에 따라, 이러한 약제는 치료 효과나 환자의 컴플리언스를 향상시키기 위해서 병용 요법의 일환으로서 사용되는 경우가 많아지고 있습니다. 게다가 제약 연구의 지속적인 진보가 기술 혁신을 더욱 가속화하고 제품의 유효성을 높이고 있습니다.

| 시장 범위 | |

|---|---|

| 시작 연도 | 2024년 |

| 예측 연도 | 2025-2034년 |

| 시작 금액 | 192억 달러 |

| 예측 금액 | 386억 달러 |

| CAGR | 7.4% |

2024년에는 2형 당뇨병 관리 부문이 67.8%의 점유율을 차지했습니다. 이 부문의 우위성은 당뇨병의 부담이 증대하는 가운데, 효과적인 해결책이 긴급하게 필요하다는 것을 반영하고 있습니다. 특기할 만한 것은 치료 효과를 높이기 위해 많은 의사들이 다른 경구 당뇨병 치료제와 함께 이러한 억제제를 처방하는 것을 선호하게 되었다는 것입니다. 여러 질환 인자에 동시에 대처할 수 있기 때문에 현대 당뇨병 관리의 중요한 요소가 되고 있습니다.

세계 시장 세분화 시장은 유통 채널별로 병원 약국, 소매 약국, 온라인 약국으로 구분됩니다. 2024년 현재 병원 약국 부문은 2025-2034년 CAGR 7.1%로 성장할 것으로 예측되며, 이는 입원 환자 및 외래 환자를 대상으로 전문적인 치료 솔루션을 제공하는 중심적인 역할을 담당하고 있기 때문입니다. 병원 약국의 지배적인 지위는 조정된 케어 경로를 지원하고 임상 회귀를 개선하는 고급 약국 서비스의 통합에서 유래합니다. 이러한 약국은 입원환자의 복약 관리에 중요한 역할을 하고 있으며, 특히 급성기 의료 현장에서는 처방된 치료약을 적시에 투여하는 것을 보증하고 있습니다.

미국의 SGLT2 억제제 2024년 시장 점유율은 41.1%로 평가되었고, 2034년까지 연평균 복합 성장률(CAGR) 7.2%로 성장할 전망입니다. 미국은 2034년에 73억 달러를 창출할 것으로 예측됩니다. 이 나라의 성장 궤도를 지지하고 있는 것은, 강고한 헬스케어 인프라, 환자의 치료에 대한 광범위한 액세스, 처방전의 채용을 재촉하는 강력한 상환 정책입니다. 한편, 유럽과 아시아태평양 시장은, 진단율 향상, 의료 투자 증가, 혁신적 치료에 대한 폭넓은 액세스에 의해, 큰 견인력을 보이고 있습니다.

세계의 SGLT2 억제제 산업에서 Merck, Lupin Limited, Glenmark Pharmaceuticals, Astellas, Boehringer Ingelheim International, Lexicon Pharmaceuticals, AstraZeneca, Johnson & Johnson (Janssen Pharmaceuticals), Sanofi, Eli Lilly and Company, TheracosBio 및 Bristol-Myers Squibb Company 등 유력한 기업입니다. 세계의 SGLT2 억제제 시장에서의 지위를 강화하기 위해, 각사는 전략적 파트너십이나 공동 마케팅 계약, 임상 적응의 확대 등에 적극적으로 투자하고 있습니다. 북미와 유럽의 대기업은 연구개발 파이프라인을 활용해 당뇨병뿐만 아니라 심부전 및 신장병도 타깃으로 한 선진적인 제제를 개발하고 있습니다. 아시아태평양 지역의 기업은 수요 증가에 대응하기 위해 제조 능력을 확대하고 판매 제휴를 맺고 있습니다.

The Global SGLT2 Inhibitors Market was valued at USD 19.2 billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 38.6 billion by 2034, driven by the increasing global prevalence of type 2 diabetes, a condition affecting millions due to lifestyle factors such as physical inactivity, aging populations, and rising obesity rates. These medications stand out in the therapeutic landscape because they offer multiple benefits beyond lowering blood sugar, particularly for patients with cardiovascular and renal complications. Their expanding role in managing chronic health conditions has significantly broadened their patient base.

Unlike traditional diabetes medications, SGLT2 inhibitors reduce glucose levels by promoting glucose excretion through the kidneys, which not only supports glycemic control but also contributes to cardiovascular and kidney protection. This makes them a preferred option among both patients and healthcare providers. With mounting evidence from clinical studies showing reduced hospitalization rates and mortality in heart failure and kidney disease patients, these drugs are increasingly used as part of combination therapies to improve treatment efficacy and patient compliance. Additionally, ongoing advancements in pharmaceutical research are further accelerating innovation and enhancing product effectiveness.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $19.2 Billion |

| Forecast Value | $38.6 Billion |

| CAGR | 7.4% |

In 2024, the segment for managing type 2 diabetes held a 67.8% share. The dominance of this segment reflects the urgent need for effective solutions amid the growing diabetes burden. Notably, many physicians now favor prescribing these inhibitors alongside other oral antidiabetic agents to amplify therapeutic outcomes. Their ability to address multiple disease factors simultaneously has made them a cornerstone of modern diabetes management.

By distribution channel, the global SGLT2 inhibitors market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. As of 2024, the hospital pharmacies segment will grow at a CAGR of 7.1% from 2025-2034, driven by its central role in delivering specialized treatment solutions across inpatient and outpatient settings. The dominant position of hospital pharmacies stems from their integration of advanced pharmacy services that support coordinated care pathways and improve clinical outcomes. These pharmacies play a crucial role in medication management for hospitalized patients, ensuring the timely administration of prescribed therapies, especially in acute care settings.

United States SGLT2 Inhibitors Market held 41.1% share in 2024 and will grow at a 7.2% CAGR through 2034. United States generated USD 7.3 billion in 2034. The country's growth trajectory is supported by a robust healthcare infrastructure, widespread patient access to treatments, and strong reimbursement policies encouraging prescription adoption. Meanwhile, Europe and the Asia-Pacific markets are showing significant traction due to improved diagnosis rates, rising healthcare investments, and broader access to innovative therapies.

Prominent players in the Global SGLT2 Inhibitors Industry include Merck, Lupin Limited, Glenmark Pharmaceuticals, Astellas, Boehringer Ingelheim International, Lexicon Pharmaceuticals, AstraZeneca, Johnson & Johnson (Janssen Pharmaceuticals), Sanofi, Eli Lilly and Company, TheracosBio, and Bristol-Myers Squibb Company. To strengthen their position in the Global SGLT2 Inhibitors Market, companies are actively investing in strategic partnerships, co-marketing agreements, and expanding clinical indications. Major players in North America and Europe are leveraging R&D pipelines to develop advanced formulations targeting not just diabetes, but also heart failure and kidney disease. Firms in Asia-Pacific are expanding manufacturing capacities and forming distribution alliances to meet rising demand.